By G. Nanthinee Shree

Long before I could afford or access Netflix, I exclusively watched local Singaporean dramas. I remember being away from home for two weeks, which meant I was set to miss my favourite local Tamil drama, Vettai (2011).

However, thanks to the new streaming service Xinmsn (a collaboration between Mediacorp and MSN.com) from Mediacorp, Singapore’s national broadcaster, I was able to catch up on every episode while abroad. My earliest memory of streaming digital content dates back to 2011, during a family holiday in India, where I had to connect my laptop to a hotel ethernet cable just to access xinmsn.com.

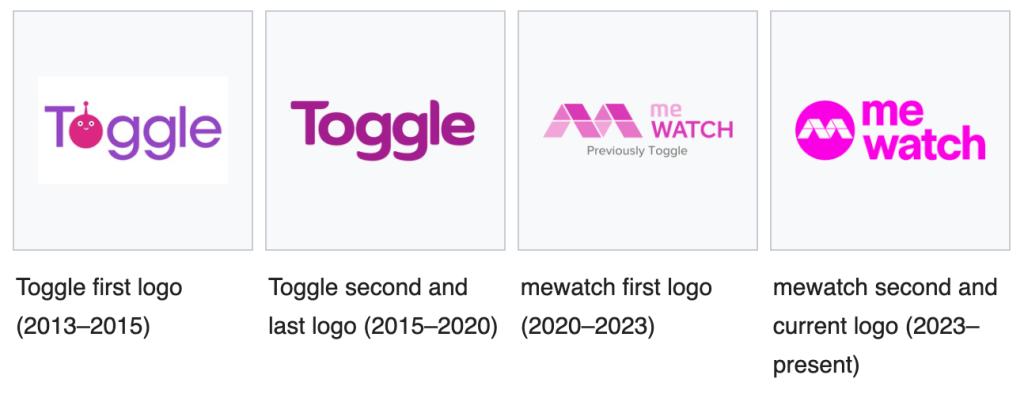

This personal milestone aligns with Amanda Lotz’s observation that 2010 saw significant developments that made internet distribution technology more usable (Jenner, 2018). At the time, Xinmsn consisted solely of local and international library titles and catch-up content for current Mediacorp shows (Mediacorp, 2010). It eventually merged with Mediacorp’s independent video-on-demand service, Toggle (now known as mewatch), in 2015. Mediacorp’s decision to collaborate with Microsoft’s MSN Singapore, which offered entertainment news and Windows Live services, emphasises how the medium responds to a “need” to combine existing media forms, such as radio, newspapers, theatre, and cinema, into one (Jenner, 2018).

While Toggle launched in 2013, it was not until 2016 that it began offering made-for-digital productions under the “Toggle Originals” brand. This shift and the subsequent pressure on the Singaporean broadcaster to produce exclusive digital content can be traced back to 2012, when Netflix began publishing “Netflix Originals” (Jenner, 2018). Unlike Netflix, which does not have a traditional television channel, Mediacorp was able to broadcast its Toggle Originals, such as the Chinese drama I Want to Be a Star, on its linear channels like Channel 8 as well.

It is worth highlighting that when traditional broadcasters branch out into over-the-top (OTT) platforms, they face unique challenges that a platform like Netflix never encounters. In an entertainment industry as small as Singapore’s, Mediacorp must constantly consider the viability of its digital content for terrestrial broadcast. Consequently, the remnants of scheduling and censorship still govern how Mediacorp produces and polices its content. A significant shortcoming of Mediacorp’s digital content is that it remains tethered to the logic of linear television, where it must select content believed likely to attract the largest possible audience (Lotz, 2017).

This is further exacerbated by stringent censorship rules regarding OTT content in Singapore (Staff Reporter, 2020). One way the broadcaster navigates these limitations is by publishing “uncensored” cuts of episodes exclusively on its YouTube channel while keeping the “TV-safe” versions on mewatch.

While Netflix has undeniably transformed Singapore’s digital content space, we must acknowledge that in a heavily regulated country where the biggest player is the national broadcaster, a creator’s freedom to experiment with representation and diverse storytelling is still very much tied to the constraints of linear television.

Works cited:

Jenner, M. (2018). Netflix and the re-invention of television. Palgrave Macmillan.

Lotz, A. D. (2017). Portals: A treatise on internet-distributed television. Maize Books. https://doi.org/10.3998/mpub.9699689

Mediacorp. (2010, February 23). Microsoft and Mediacorp enter strategic partnership to create new online portal [Press release]. https://web.archive.org/web/20140203012046/http://mediacorp.sg/en/media/EDC101020-0000272/microsoft%20and%20mediacorp%20enter%20strategic%20partnership%20to%20create%20new%20online%20portal

Staff Reporter. (2020, February 10). Singapore is Netflix’s most censored market. Campaign Asia. https://www.campaignasia.com/article/singapore-is-netflixs-most-censored-market/457440

Leave a comment